Medium-Term Management Plan

- HOME

- IR Information

- Management Policies and Strategies

- Medium-Term Management Plan

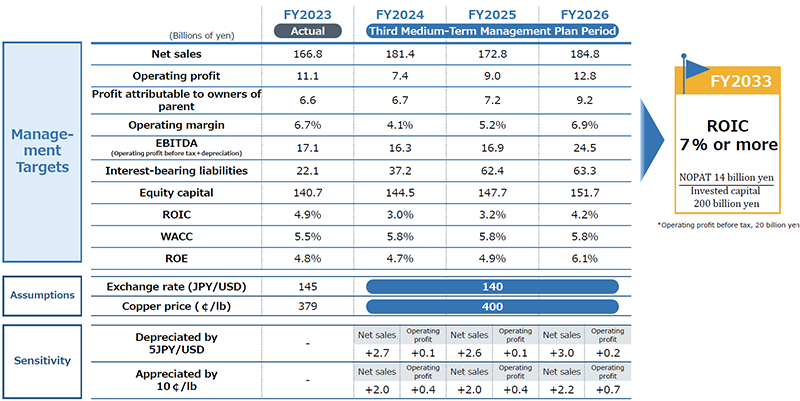

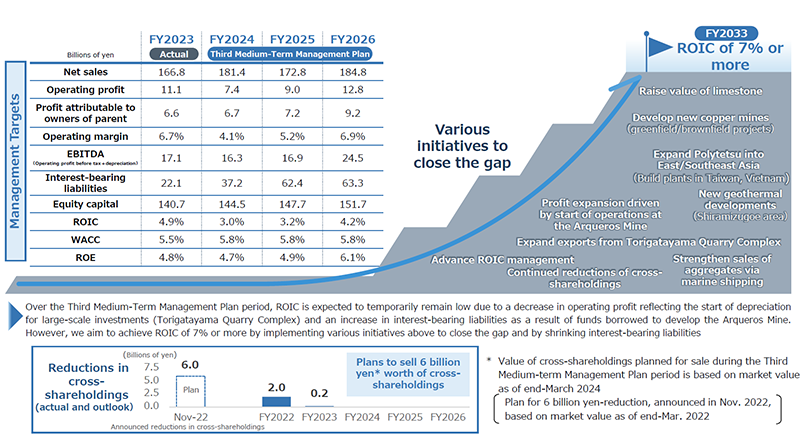

Third Medium-Term Management Plan (FY2024 to FY2026)

Long-Term Vision (Vision FY2033)

Achieve sustainable growth by contributing to society through the development and stable supply of mineral resources and by harnessing the collective strengths of the Group as an integrated mineral resources company.

Long-Term Management Goal for FY2033

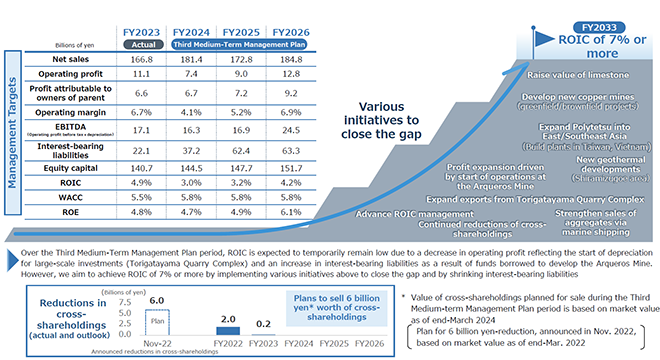

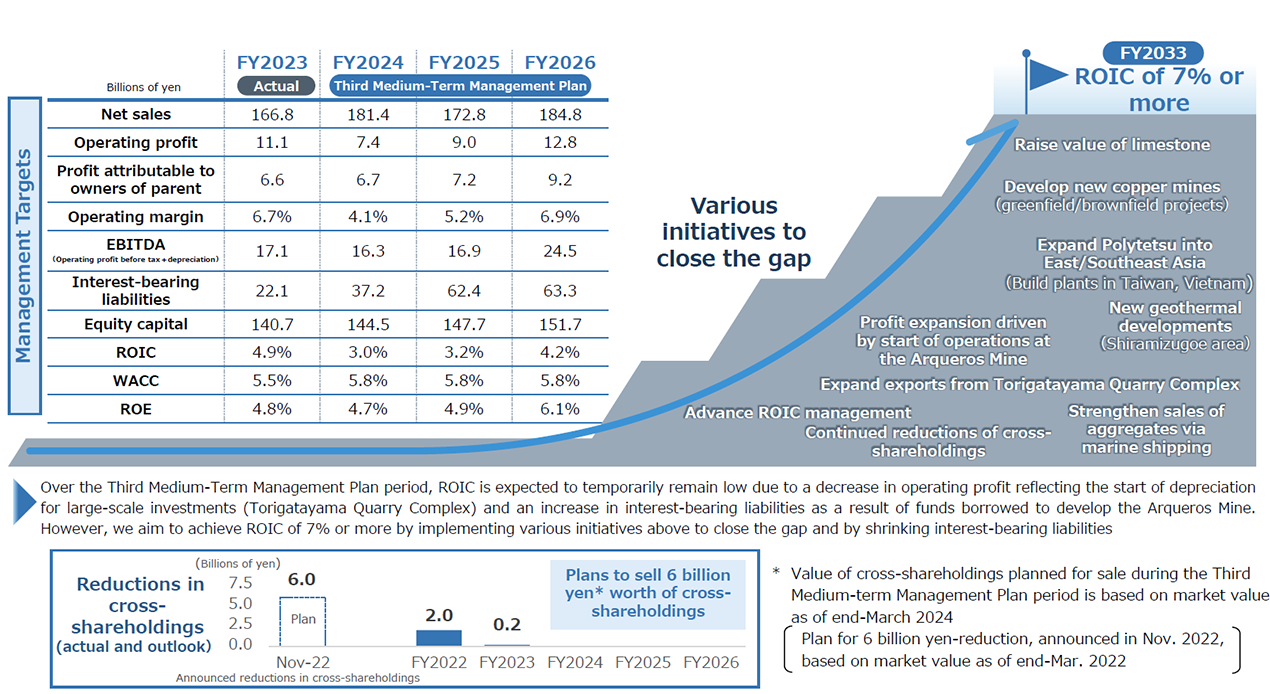

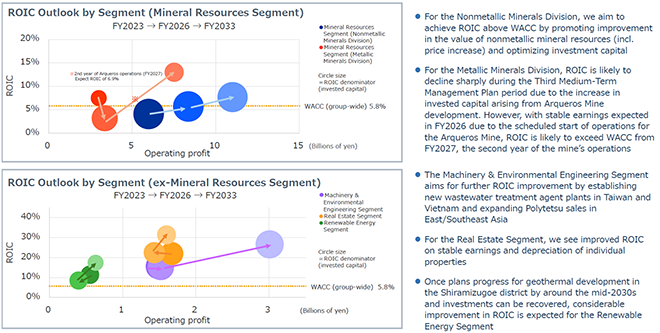

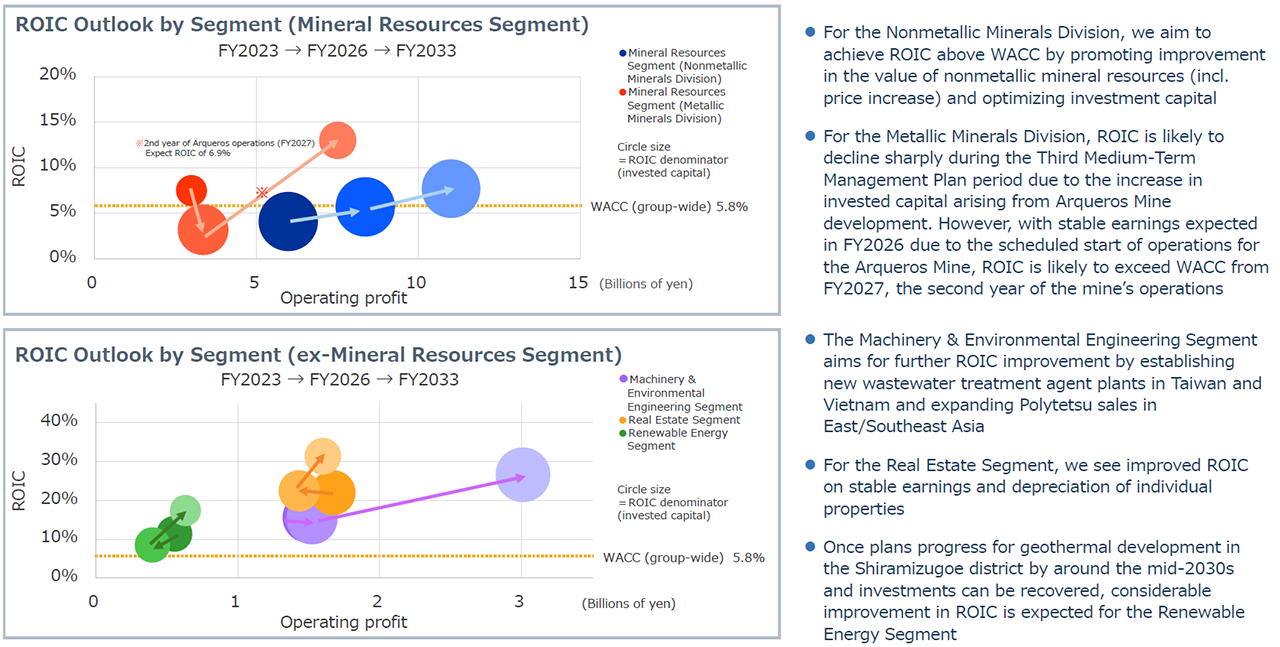

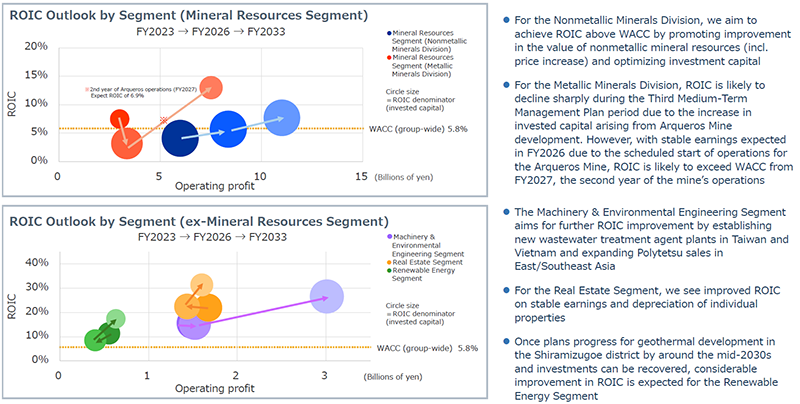

ROIC (return on invested capital) 7% or more

Third Medium-Term Management Plan Basic Policy

- In adopting and using ROIC as a management indicator, we aim for its uptake and entrenchment down from the company to individual business segments and from individual business segments to individual business sites, as well as for improved capital efficiency

- Steady progress with Arqueros Mine development and achieve start of operations

- Initiatives to optimize limestone supply, centered on Torigatayama Quarry Complex

- Continue initiatives to develop new markets (limestone, Polytetsu)

- Secure and develop new resources, regardless of interest (major/minor) or approach (greenfield/brownfield)

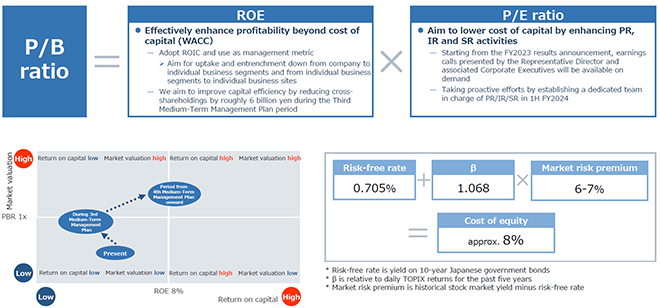

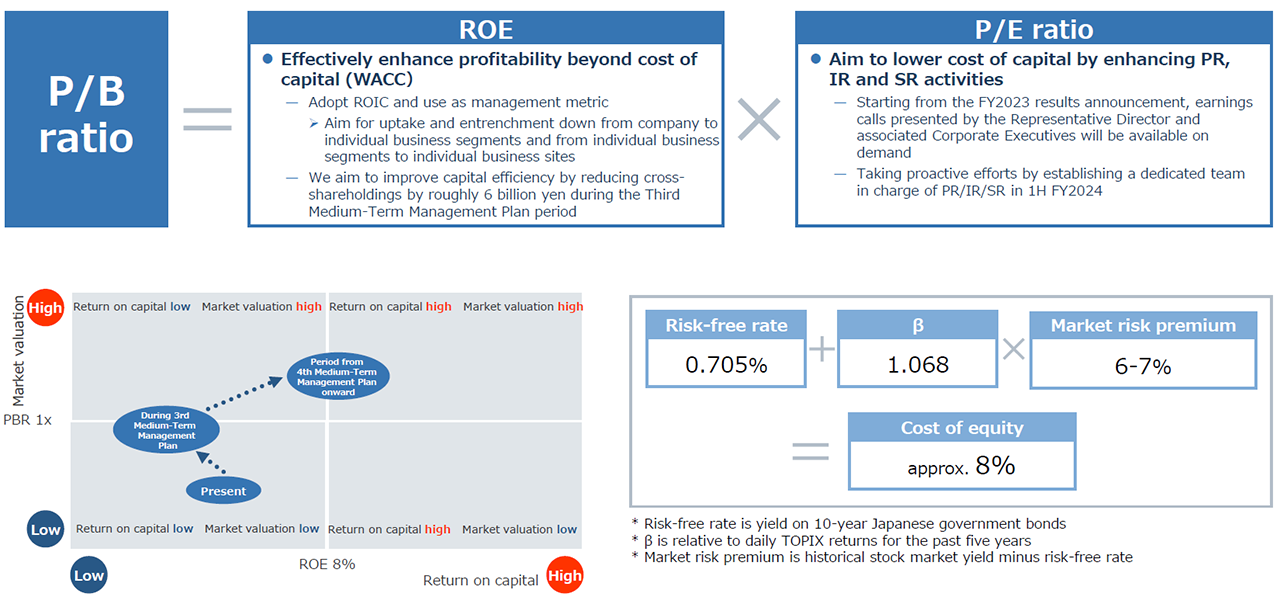

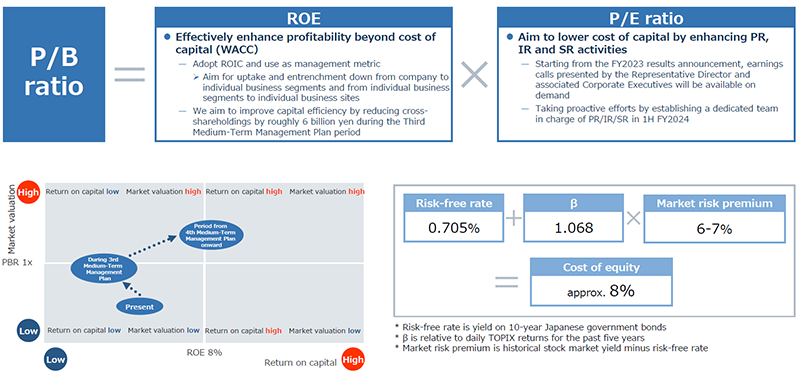

Initiatives for Management Conscious of Cost of Capital and Share Price

- We have introduced ROIC as a management indicator and aim for its uptake and instilment not just by individual business segments but also at the level of individual business sites, so as to achieve a better business portfolio

- As part of initiatives for management conscious of cost of capital and share price, we are striving for P/B ratio of 1.0x by lowering cost of equity and enhancing IR activities

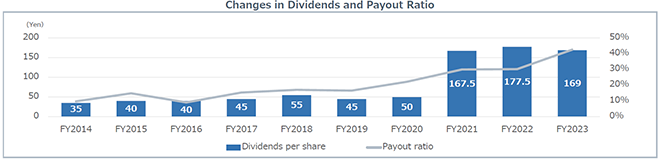

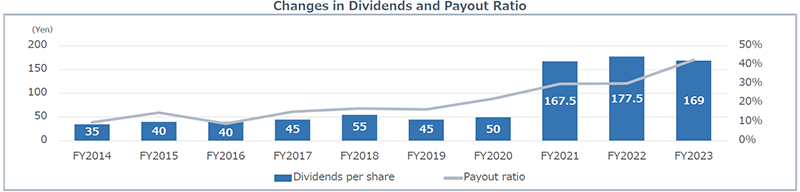

- Based on the basic policy of paying stable dividends over the long term while maintaining an optimal balance between equity and shareholder returns, we will pay dividends with a target consolidated payout ratio of 40%

Additionally we set an absolute lower limit for the dividend of 34 JPY(※) per share

The dividend will be paid based on whichever is higher

(※)The policy regarding the lower limit was changed on Feb.6 2025,while the payout ratio in the policy remains unchanged

The lower limit was adjusted for share split effective on Oct.1 2025

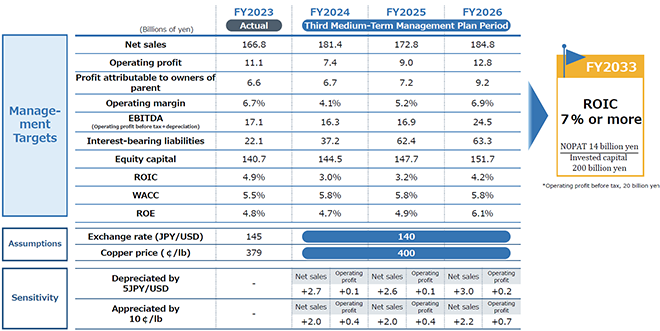

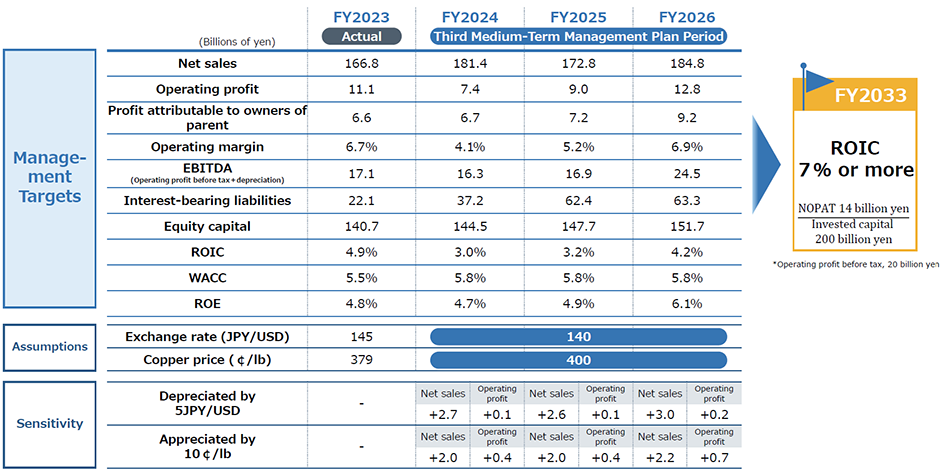

Financial Indicators and Medium-To Long-Term Management Targets

Financial Indicators and Medium-To Long-Term Management Targets (1)

Financial Indicators and Medium-To Long-Term Management Targets (2)

Management Conscious of Cost of Capital and Share Price

Management Conscious of Cost of Capital and Share Price: Challenges and initiatives (1)

Management Conscious of Cost of Capital and Share Price: Challenges and initiatives (2)

Shareholder Returns Policy

Our core business, the mining industry, is an extremely long-term business, starting with research and development before moving on to subsequent operations spanning several decades or more. During that time, profits will vary due to changes in economic and business conditions, fluctuations in the price of resources, and other factors

In order to achieve sustained growth, we must be prepared for large-scale investment in the future, given not only the nature of our business, meaning the considerable size of investments for mine development and long investment recovery cycles, and the start of new mine development in light of mineral depletion at existing mines

As a result, our basic policy has been to pay stable dividends over the long term while maintaining an optimal balance between equity and shareholder returns

Dividend Policy in Third Medium-Term Management Plan

Based on the basic policy of paying stable dividends over the long term while maintaining an optimal balance between equity and shareholder returns,we will pay dividends with a target consolidated payout ratio of 40%

Additionally we set an absolute lower limit for the dividend of 34 JPY(※) per share

The dividend will be paid based on whichever is higher

(※)The policy regarding the lower limit was changed on Feb.6 2025,while the payout ratio in the policy remains unchanged

The lower limit was adjusted for share split effective on Oct.1 2025

Related Materials

- FY2024-2026 Third Medium-Term Management Plan

- [With Script]FY2024-2026 Third Medium-Term Management Plan

- Information Regarding Changes to Shareholder Return Policy

- New reduction policy in cross-shareholdings(P.20 of FY24 Financial results materials)

- Notice of Share Split,Articles Amendment Following Share Split,Dividend Forecast Revision,and Shareholder Return Policy Change

Note: Details concerning the plans or forecasts appearing on this page were prepared based on certain conditions determined to be reasonable by the Company at the time of announcement. The Company does not guarantee the accuracy or completeness of this information. Actual business performance could vary substantially from the plans outlined here due to various risk factors and other elements of uncertainty.